W4 Form 2024, Employee’s Withholding Certificate | IRS Tax Forms 2024 – Are you ready to take control of your tax withholdings and maximize your paycheck? Look no further than the W4 Form 2024, Employee’s Withholding Certificate, a crucial document that empowers employees to determine how much federal income tax gets withheld from their pay.

As we step into the year 2024, understanding the intricacies of this IRS tax form becomes increasingly important for individuals looking to optimize their financial well-being. Whether you’re a seasoned professional or just starting in the workforce, mastering the W4 Form can have a significant impact on your bottom line. So, let’s delve into the upcoming changes and updates in the W4 Form 2024 and explore how it can shape your financial future.

The W4 Form 2024 may seem like just another bureaucratic requirement, but its implications are far-reaching and directly affect your take-home pay. Imagine having the ability to tailor your tax withholdings according to your circumstances—whether it’s getting married, having a child, taking on multiple jobs, or experiencing life-changing events—all while staying compliant with IRS regulations.

or

The W4 Form is not just about filling out numbers; it’s about understanding how those numbers can work in your favor. In this article, we will unravel the complexities of the W4 Form 2024 and equip you with knowledge that could potentially put more money back in your pocket come tax time. Get ready to uncover strategies for optimizing your withholding allowances and harnessing greater control over your finances as we navigate through this essential IRS document together.

What is W4 Form 2024?

The W4 Form 2024, also known as the Employee’s Withholding Certificate, is an essential document for anyone earning a wage or salary in the United States. As we approach the tax year 2024, understanding the nuances of this form becomes critical for employees to ensure accurate tax withholding from their paychecks. This guide is designed to demystify the W-4 form for both new employees and experienced workers.

What is the Purpose of the W4 Form 2024?

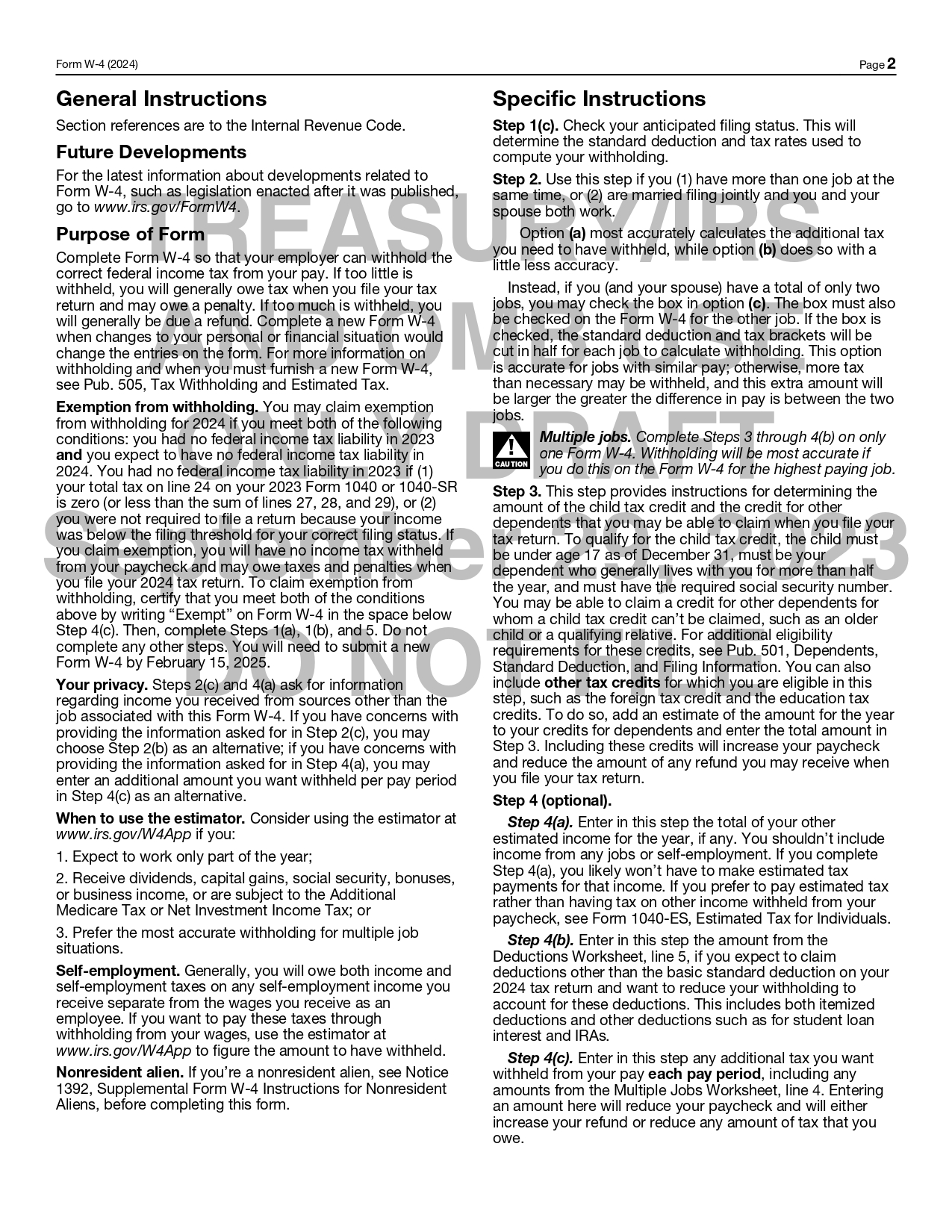

The primary purpose of the W4 Form 2024 is to instruct employers on how much federal income tax to withhold from your paycheck. The amount of tax withheld is influenced by your income, filing status (such as single, married, or head of household), and any additional adjustments you specify on the form.

Filling out the W4 Form 2024 accurately is crucial. If too little tax is withheld, you may owe a significant amount when filing your tax return. Conversely, if too much tax is withheld, your monthly budget might be tighter than necessary, although you might receive a large refund when you file your taxes.

It’s important to note that the W-4 form 2024 underwent significant changes in recent years, simplifying the process of inputting personal information and eliminating the use of allowances, which were tied to personal exemptions. For the tax year 2024, ensure you’re using the latest version of the form, which reflects current tax laws and standard deductions.

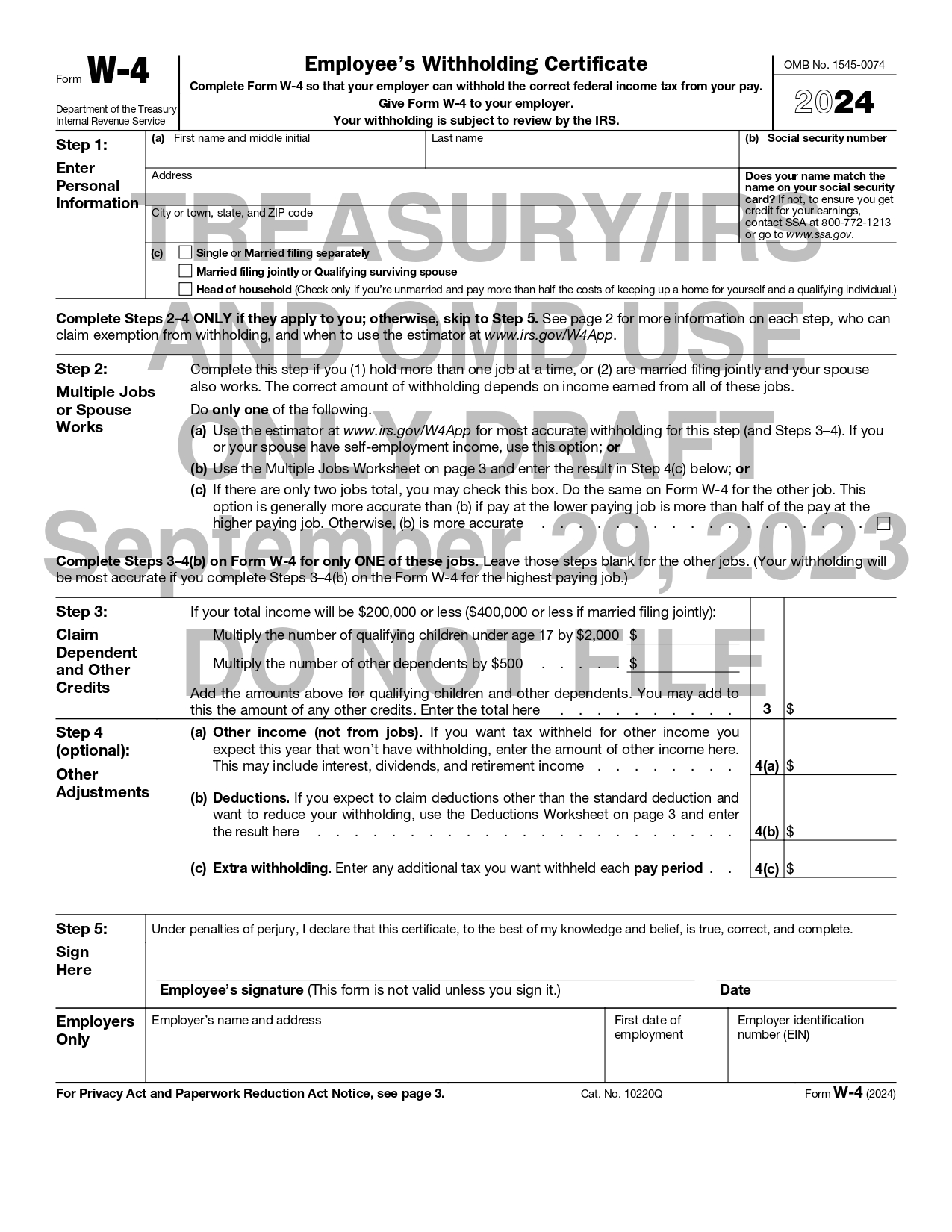

How to Fill Out the W-4 Form 2024?

Below is the general guide on how to fill out the W4 Form 2024:

- Personal Information: This section is straightforward, requiring your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If you have more than one job or if you’re married filing jointly and your spouse also works, this section helps in adjusting the amount of tax withheld.

- Claim Dependents: Here, you can claim dependents, such as children, which will decrease the amount of tax withheld.

- Other Adjustments: This section is for additional income not from jobs, deductions other than the standard deduction, and any extra withholding you’d like from each paycheck.

- Final Declaration: After completing the form, sign and date it before submitting it to your employer.

What are W-4 Forms Used For?

The W-4 form, officially known as the Employee’s Withholding Certificate, is a critical document in the United States tax system, particularly for employees. Its primary role is in the realm of income tax withholding. This article will delve into the specific functions of the W-4 form, shedding light on its importance for both employees and employers in the tax year 2024.

Here is an overview of the purposes for which the W4 Form 2024 is used:

- Determining Tax Withholding: The most fundamental purpose of the W-4 form is to guide employers on how much federal income tax to withhold from an employee’s paycheck. This withholding is based on the employee’s earnings, coupled with the personal information and selections made on the W-4 form.

- Tailoring to Individual Tax Situations: Each individual has a unique tax situation, influenced by factors such as marital status, income level, and dependents. The W-4 form allows employees to personalize their tax withholding to match their specific circumstances. This personalization helps in avoiding underpayment or overpayment of taxes throughout the year.

The Significance of Accurate Completion of the W-4 Form:

- Avoiding Tax Bills or Penalties: Incorrectly filling out the W-4 can lead to insufficient tax being withheld, resulting in a tax bill and potential penalties at the end of the year. Conversely, over-withholding can result in a larger tax refund, which might seem beneficial but essentially means you’ve given the government an interest-free loan.

- Reflecting Life Changes: Life events such as marriage, divorce, the birth of a child, or a change in income necessitate a reevaluation and potential update of your W-4 form. These updates ensure that tax withholding accurately reflects your current situation.

How the W-4 Form Influences Paychecks and Tax Returns?

The W4 form 2024 is a vital tool in managing your financial affairs, particularly regarding paychecks and tax returns. The decisions you make while filling out this form have both immediate and long-term effects on your finances. Let’s explore these impacts in more detail:

1. Immediate Impact on Paychecks

When you complete a W-4 form, the information you provide directly influences the amount of federal income tax withheld from each of your paychecks. Here’s how it works:

- Adjusting Withholding: The W-4 form includes options to adjust your tax withholding based on various factors like your marital status, number of jobs, and any additional income.

- Claiming Dependents: Each dependent you claim potentially reduces the amount of tax withheld. This is because the more dependents you have, the lower your taxable income, leading to less tax being taken out of your paycheck.

- Additional Deductions: If you choose to itemize deductions or have significant non-wage income, you can account for these on the W-4. This further adjusts the amount withheld, ensuring it more accurately matches your tax liability.

- Net Paycheck Changes: As a result of these adjustments, the net amount – the amount you take home after taxes and other deductions – of your paycheck can increase or decrease. For instance, if you claim more allowances or deductions, less tax is withheld, resulting in a larger paycheck.

2. Long-Term Impact on Annual Taxes

The choices you make on your W-4 form don’t just affect your immediate take-home pay; they also have implications for your annual tax filing:

- Aligning Withholding with Tax Liability: The goal of accurate W-4 completion is to ensure that the amount withheld from your paychecks over the year closely matches your actual tax liability. This reduces the likelihood of surprises during tax season.

- Avoiding Underpayment or Overpayment: If too little tax is withheld, you could face a large tax bill and potential penalties at year-end. Conversely, if too much is withheld, you might receive a substantial refund, which some might view as giving the government an interest-free loan.

- Year-End Tax Return Simplicity: Ideally, with precise W-4 adjustments, your annual tax return should be a straightforward affair. You shouldn’t owe much additional tax nor receive a large refund, making your tax return a “non-event.”

The way you fill out your W4 Form 2024 has significant and tangible effects on both your immediate financial situation, in terms of your regular paychecks, and your annual tax filings. It’s crucial to understand these impacts to make informed decisions that align with your financial goals and obligations.

What is a W-4 Calculator/Estimator?

A W-4 calculator or estimator is an online tool designed to help you determine the correct amount of federal income tax to be withheld from your paycheck. It takes into consideration various factors, such as your income, filing status, number of dependents, and other tax-related information, to provide a personalized recommendation on how to fill out your W4 Form 2024.

How Does the W-4 Calculator Work?

- Gathering Information: The calculator typically begins by asking you to input basic information, including your filing status (single, married filing jointly, etc.), income details, and any additional sources of income.

- Dependents and Deductions: You’ll then enter information about dependents and any anticipated tax deductions, which could reduce your taxable income.

- Tailored Recommendations: Based on the information provided, the calculator assesses your tax situation and offers recommendations on how to complete your W-4 form. This may include suggestions on how many allowances to claim or additional amounts to withhold.

Benefits of Using a W-4 Calculator?

- Accuracy in Withholding: The primary benefit is ensuring that the correct amount of tax is withheld from your paycheck. This accuracy helps avoid underpaying taxes throughout the year, which could result in a tax bill, or overpaying, which gives you a larger refund than necessary.

- Adjusting to Life Changes: Life events such as marriage, the birth of a child, or a change in employment status can significantly affect your tax situation. The W-4 calculator helps adjust your withholding to reflect these changes.

- Ease of Use: These calculators are user-friendly and often provide step-by-step guidance, making it easier for individuals unfamiliar with tax jargon.

When to Use a W-4 Calculator?

- Annual Checkup: It’s recommended to use the calculator annually, especially if there have been changes in your tax situation.

- After Major Life Events: Significant life changes like marriage, divorce, childbirth, or a change in income necessitate a reevaluation of your tax withholding.

- Tax Law Changes: Whenever there are updates to tax laws, using a W-4 calculator can help you understand how these changes affect you.

The W-4 calculator/estimator is an indispensable tool for anyone looking to optimize their tax withholding. By using this tool, you can ensure that the amount withheld from your paycheck aligns with your actual tax liability, thereby smoothing out your financial planning and avoiding any unwelcome surprises during tax season. Remember, staying proactive and informed about your tax withholding can make a significant difference in your financial well-being.

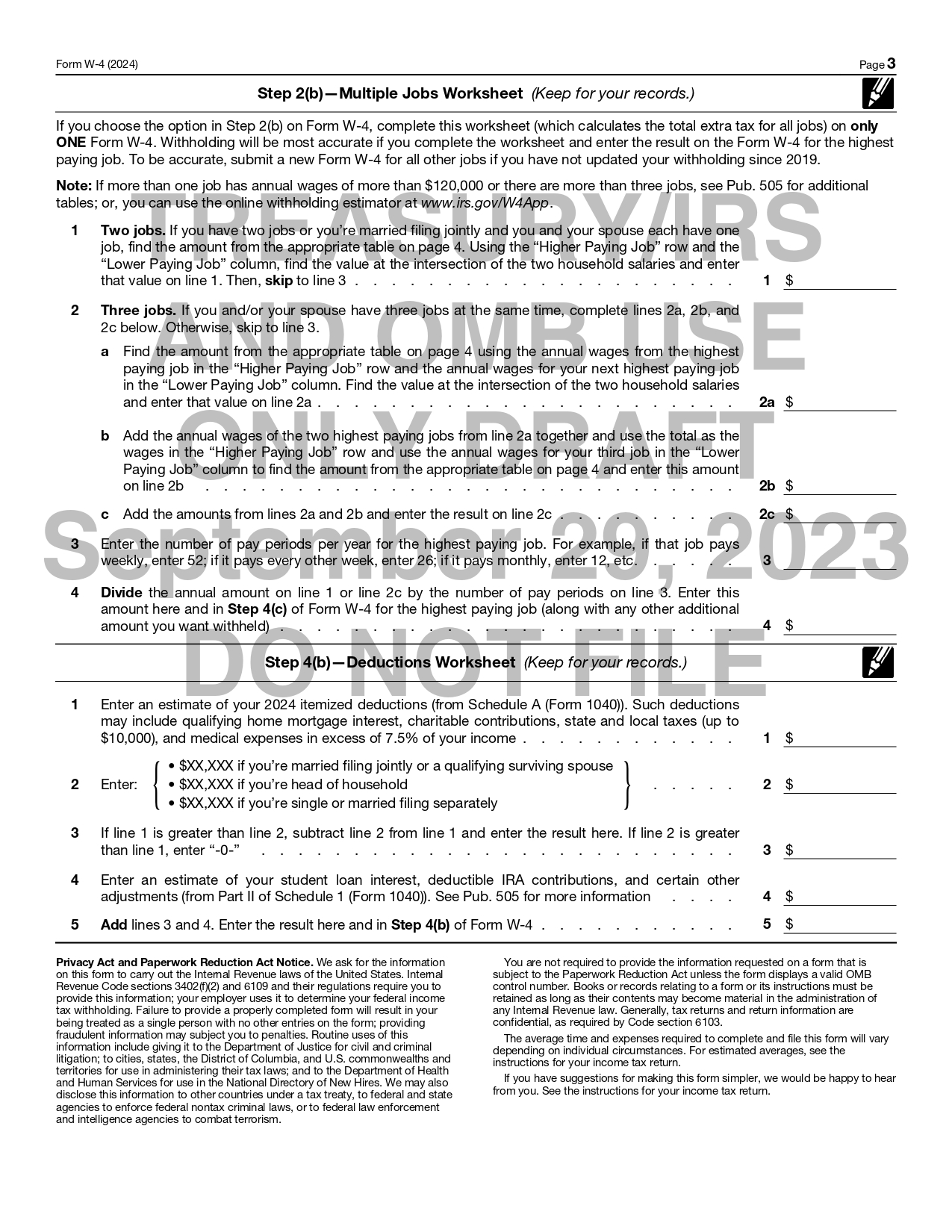

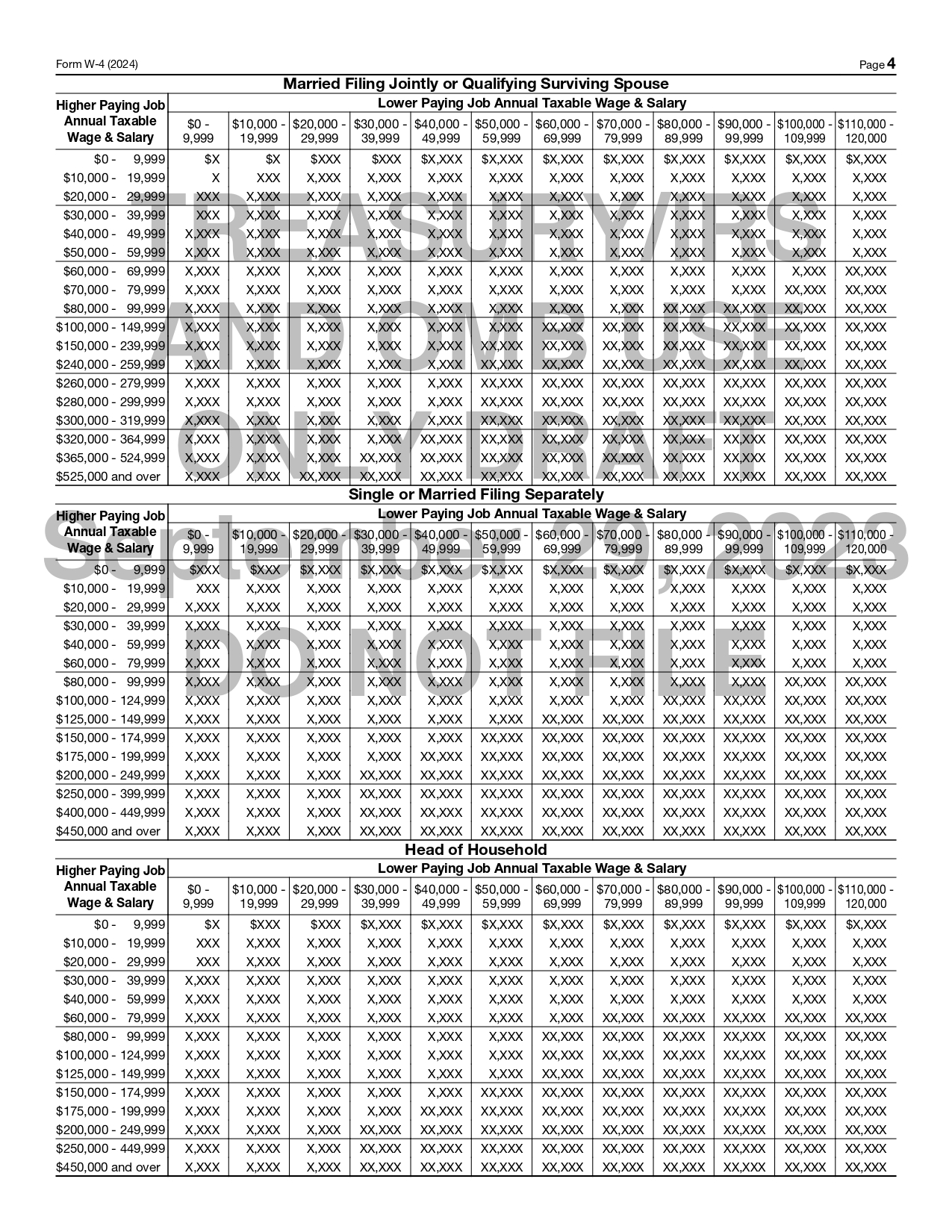

W4 Form 2024 Draft Version

The IRS has released the draft version of the W4 Form 2024. However, the final, printable, and fillable version of the w4 form 2024 has not yet been released. Please note that the draft version is for review purposes only and should not be used for actual filing.

Note: The IRS has not yet released the final version of the W4 Form 2024. As of now, only the draft version of the form has been made available.

W4 Form 2024, Employee’s Withholding Certificate (Draft Version) Images

FAQs on W-4 Form for New Employment and Updates

1. Do I need to fill out a W-4 form when I start a new job?

Yes, when you begin a new job, it is typically required to fill out a W-4 form. This form is crucial as it informs your employer about the amount of federal income tax to withhold from your paychecks. Accurately completing the W-4 ensures that the correct tax amount is withheld.

2. Where can I download the new Form W-4?

The latest Form W-4 can be downloaded from the IRS website. Visit www.irs.gov and search for “Form W-4.” The IRS provides the most current version of the form, along with detailed instructions for completion.

3. Where should I send an updated W-4 form?

You do not need to mail your completed W-4 form to the IRS. Instead, it should be submitted directly to your employer. Your employer will use the information from the W-4 to withhold the appropriate amount of federal income tax from your wages.

Here are more comprehensive FAQs about the W4 Form 2024.